Construction activity remains steady across the country as residential and digital projects carry the load against weaker office and civic pipelines.

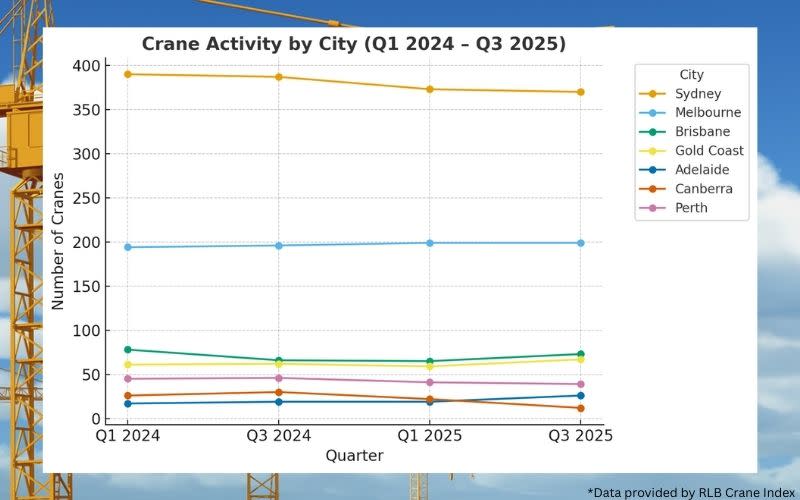

The September quarter Crane Index from Rider Levett Bucknall (RLB) counted 845 cranes nationwide, down from the early-2024 peak of 869 but still well above the long-term average of 775.

It’s the eighth consecutive index above 800, underlining the sector’s resilience despite cost and financing pressures.

Sydney remains the epicentre with 370 cranes—43.8 per cent of the national total—though down slightly on the previous survey.

Melbourne held at 199, anchored by large commercial and infrastructure projects including the $36-billion North-East Link, which alone deployed 46 cranes.

Queensland’s momentum is growing.

Brisbane lifted to 73 and the Gold Coast to 67, each adding eight and together accounting for 140 cranes.

Adelaide climbed to 26, Wollongong to 20 and Darwin to four—all record highs—while Canberra fell from 22 to 12 as civic projects wrapped up.

“The Australian construction sector holds firm, with the national crane count rising slightly from 840 to 845, well above the long-term average of 775,” RLB research director Oliver Nichols said.

“What we are seeing is a shifting of activity across different regions and asset classes.”

Residential remains dominant with 498 cranes, almost 59 per cent of the total.

Mixed-use projects rose to 108 and data centres to 32.

Health and hotels rose, while commercial fell by 12, civic by six and aged care by five.

Melbourne’s Palmers Road data centre at Truganina recorded the largest single-site deployment with six cranes, highlighting the growing scale of digital infrastructure investment.

Australian Bureau of Statistics (ABS) figures for the June quarter showed total construction activity was up 3 per cent to $76.1 billion.

Engineering rose 6.1 per cent to $37.1 billion, driven by infrastructure.

Building edged up to $39 billion, split between $24.2 billion of residential and $14.9 billion of non-residential.

Approvals point to a solid pipeline.

More than 47,000 homes were approved in the June quarter, valued at almost $24 billion and up 18 per cent year-on-year.

Non-residential approvals hit $21.8 billion, up 30.6 per cent, led by education, office, industrial and data infrastructure.

The scale of approvals suggests crane activity will remain elevated into 2026, though project feasibility is still being tested by labour shortages, high costs and financing constraints.

“Despite the overall drop in crane numbers from a year ago, the crane index metrics, together with the construction work data, and approvals point to a sector that remains stable while reallocating resources,” Nichols said.

“The emphasis is shifting towards infrastructure, density and digital capacity, with regional hotspots and sectoral transitions shaping Australia’s next phase of development.”